Discover if long term care insurance covers assisted living expenses in this comprehensive guide to understanding long term care insurance.

Introduction to Long Term Care Insurance

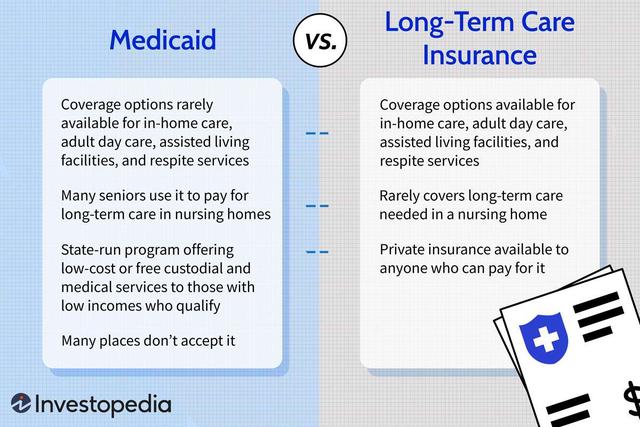

Long-term care insurance (LTC) is a type of policy designed to cover the costs of long-term care services. This type of care includes not just medical care, but also personal care such as help with bathing and dressing. As people age, there is a high likelihood of needing some form of long-term care, with nearly 70% of individuals turning 65 today expected to require long-term care at some point in their lives. Long-term care insurance can help cover the costs of care in various settings, including assisted living facilities. It is important to understand the coverage terms, limitations, and premium costs before purchasing a long-term care insurance policy.

Who is eligible for long-term care insurance?

There is no specific age requirement for long-term care insurance, and nearly any healthy adult can qualify. However, individuals with pre-existing medical conditions may be considered high risk and could be denied coverage. It is generally advisable to purchase long-term care insurance when you are relatively young and healthy, as most claims are filed after the age of 70. Additionally, it is important to ensure that the policy specifically covers care in an assisted living facility if that is a potential future need.

What assisted living expenses are covered by long-term care insurance?

Long-term care insurance typically covers a range of services in an assisted living setting, including help with personal care tasks, therapy, and sometimes services like laundry and housekeeping. It is important to carefully review the policy to understand the specific benefits and coverage limits for assisted living care.

When does long-term care insurance coverage begin?

The coverage start date and eligibility for benefits depend on the terms and conditions outlined in the policy. Most policies have a waiting period, also known as the elimination period, during which the individual is responsible for paying for services out of pocket before the insurer begins reimbursing for care.

Long-term care insurance costs

The cost of long-term care insurance is determined by factors such as age, coverage limits, and the scope of services covered. It is important to compare costs, benefits, and drawbacks from different carriers and to ensure that the monthly premium payment is affordable.

How to choose the best long-term care insurance for you

When selecting a long-term care insurance policy, it is important to review each policy thoroughly, compare coverages and premiums from different carriers, and ensure that the coverage aligns with your individual needs. It is also important to consider factors such as your personal and family health history, as well as the potential need for long-term care in the future.

By understanding the eligibility, coverage, considerations, and best practices for choosing a long-term care insurance policy, individuals can make informed decisions about their long-term care needs and financial planning.

What is Long Term Care Insurance?

Long-term care insurance is a type of policy designed to cover the costs of long-term care services. This includes not just medical care, but also personal care like help with bathing and dressing. Many long-term care insurance policies include coverage for care provided in an assisted living setting. Long-term care involves a variety of services designed to meet your health and/or personal care needs during a short or extended period. These services, provided in different types of settings, offer vital support to help you live as independently and safely as possible.

Assisted living is a home-like residential community for older adults. It allows residents to remain independent in their own private living unit, but with round-the-clock support services to help with certain activities. People in an assisted living community don’t need the type of medical care provided in a nursing home, but they may need help with bathing, dressing, cleaning, laundry, and medication management. Fitness programs, social activities, and even salon services may also be offered in an assisted living environment.

There are two main types of long-term care insurance: traditional long-term care insurance and hybrid long-term care insurance. Traditional long-term care insurance is a standalone policy specifically designed to cover the costs of long-term care. Hybrid long-term care insurance combines long-term care coverage with life insurance or annuities.

Long-term care insurance is suitable for nearly any healthy adult, with no specific age requirement. However, if you have a pre-existing medical condition, an insurer may consider you high risk and deny your application for coverage. It’s generally best to buy long-term care insurance when you’re fairly young and healthy. Since most long-term care claims are filed after the age of 70, buying a policy between ages 50-65 is a good rule of thumb.

Long-term care insurance policies generally cover a range of services, including help with personal care tasks, therapy, and some policies also cover services like laundry and housekeeping. If you plan on entering assisted living one day, it’s important to choose a policy that specifically covers this type of facility. Most long-term care policies sold today are broad in scope, allowing you to apply your benefits in a wide range of settings.

The cost of your long-term care policy is based on many factors, including your age, coverage limits, and scope of services covered. If you’re already receiving long-term care services, or you’re in poor health, you may only be able to buy a limited amount of coverage or you’ll pay a higher rate. In some cases, people with certain high-risk factors may not qualify for long-term care insurance at all.

When buying a long-term care policy, you want to be able to make an informed decision. Some questions to ask insurers/agents include: Is there a maximum daily benefit or maximum benefits per period? Do benefits adjust with inflation? Does the policy provide an expense allowance or reimburse expenses?

There is no one-size-fits-all long-term care insurance policy. That’s why it’s important to consider your individual needs, shop around, and compare coverages and premiums from different carriers. Long-term care insurance can provide a vital financial safety net should you ever need these types of services. That said, there are many factors to consider when buying a policy. Before you sign on the dotted line, take time to explore your options—and don’t hesitate to seek the advice of a professional.

Coverage of Long Term Care Insurance

Long-term care insurance policies typically cover a range of services, including personal care tasks such as grooming, eating, and toileting, as well as therapy services like physical, speech, and occupational therapy. Some policies may also cover additional services such as laundry and housekeeping. It is important to carefully review the coverage terms of each policy to ensure that it includes the specific services you may need.

Services Covered

– Personal care tasks (e.g., grooming, eating, toileting)

– Therapy services (e.g., physical, speech, occupational)

– Additional services like laundry and housekeeping

Settings Covered

Most long-term care policies are broad in scope, allowing benefits to be applied in a wide range of settings. This may include coverage for care provided in nursing homes, assisted living facilities, home health care, adult day health care, hospice care, and memory care. It’s important to choose a policy that specifically covers the type of facility where you may receive care in the future.

It’s important to carefully review the coverage terms, limitations, and premium costs of each long-term care insurance policy before making a decision. Additionally, it’s recommended to consult with a licensed insurance agent or financial advisor to ensure that you choose the best policy for your individual needs.

Types of Long Term Care Services Covered

Long-term care insurance typically covers a variety of services designed to meet health and personal care needs over an extended period. This can include assistance with personal care tasks such as grooming, eating, and toileting, as well as therapy services like physical, speech, and occupational therapy. Some policies may also cover additional services such as laundry and housekeeping to help support individuals in their daily activities.

Assisted Living Services

Assisted living services are often covered by long-term care insurance policies. These services are provided in a residential community setting for older adults who require some level of support with activities of daily living. This can include assistance with tasks such as bathing, dressing, medication management, and household chores. Additionally, assisted living facilities may offer fitness programs, social activities, and other amenities to support the overall well-being of residents.

Other Covered Services

In addition to assisted living, long-term care insurance may also cover other types of care services. This can include coverage for nursing home care, home health care, adult day health care, hospice care, and memory care. These services cater to individuals with varying needs, from 24/7 medical and personal care in a nursing home setting to off-site care and supervision during the day for those living at home. It’s important to review the specific services covered by a policy to ensure it aligns with your potential future care needs.

By understanding the types of long-term care services covered by insurance policies, individuals can make informed decisions when selecting coverage that best meets their long-term care needs.

Assisted Living Expenses and Long Term Care Insurance

Assisted living expenses can be considerable, making it important to explore different ways to pay for them. Long-term care insurance is one option that can help cover the costs of care in an assisted living setting. When considering long-term care insurance, it’s essential to understand the coverage terms, limitations, and premium costs. It’s also important to consider when the coverage will begin, what expenses are covered, and how much coverage you’ll need based on your personal and family health history.

Long-term care insurance typically covers services such as help with personal care tasks, therapy, and sometimes even services like laundry and housekeeping. It’s important to choose a policy that specifically covers assisted living facilities if that’s where you plan to receive care. The coverage start date, waiting period before benefits start, and maximum lifetime benefit are all factors to consider when purchasing long-term care insurance. Additionally, inflation protection can be an optional feature to help keep pace with rising costs of long-term care services over time.

The cost of long-term care insurance is based on factors such as age, coverage limits, and the scope of services covered. It’s important to shop around with different carriers and get quotes on various types of policies to compare costs, benefits, and drawbacks. It’s also crucial to choose a policy that you can comfortably afford the monthly premium payment for, as rates will likely go up over time.

When it comes to choosing the best long-term care insurance, there is no one-size-fits-all policy. It’s essential to review each policy thoroughly, shop around, and compare coverages and premiums from different carriers. The right time to secure long-term care insurance is generally when you’re fairly young and healthy, as the cost is lower at a younger age. However, it’s important to consider your individual needs and financial situation before making a decision.

In summary, long-term care insurance can provide a vital financial safety net for assisted living expenses, but it’s important to thoroughly research and consider all aspects of the policy before making a decision.

Understanding Assisted Living Facilities

Assisted living facilities are residential communities for older adults that provide a combination of housing, personalized supportive services, and healthcare designed to meet individual needs. Residents in assisted living facilities have the freedom to live independently in their own private living unit, while also having access to 24/7 support services to help with activities such as bathing, dressing, medication management, and housekeeping. Additionally, assisted living facilities may offer fitness programs, social activities, and amenities such as salon services to enhance the quality of life for their residents.

Services offered in assisted living facilities:

– Personal care assistance with activities of daily living

– Therapy services, including physical, speech, and occupational therapy

– Housekeeping and laundry services

– Medication management

– Social and recreational activities

– Fitness programs

Assisted living facilities are designed to provide a supportive and safe environment for older adults who may need some assistance with daily activities but do not require the level of medical care provided in a nursing home. These facilities aim to promote independence and well-being while ensuring that residents receive the necessary support to maintain a high quality of life.

Benefits of Long Term Care Insurance for Assisted Living Expenses

Benefits of Long Term Care Insurance for Assisted Living Expenses

Long-term care insurance can provide valuable financial support for covering the costs of assisted living expenses. This type of insurance can help offset the considerable costs associated with assisted living facilities, which offer round-the-clock support services for activities of daily living. With long-term care insurance, individuals can have peace of mind knowing that they have a financial safety net to help cover the expenses of assisted living.

One of the key benefits of long-term care insurance for assisted living expenses is the coverage for personal care tasks. This can include assistance with grooming, eating, toileting, and other daily activities. Many long-term care insurance policies also cover therapy services, such as physical, speech, and occupational therapy, which can be crucial for individuals residing in assisted living facilities.

Furthermore, long-term care insurance can provide coverage for additional services like laundry and housekeeping, which can further alleviate the financial burden of assisted living expenses. This comprehensive coverage can ensure that individuals have access to the necessary support services without having to worry about the high costs associated with assisted living facilities.

In addition to the coverage for specific services, long-term care insurance also offers flexibility in choosing the type of assisted living facility. Most policies are broad in scope, allowing individuals to apply their benefits in a wide range of settings, including assisted living facilities. This flexibility ensures that individuals have the freedom to choose the assisted living facility that best meets their needs while still being able to utilize their long-term care insurance benefits.

Overall, long-term care insurance can provide significant benefits for covering assisted living expenses, offering financial support for essential services and providing flexibility in choosing the right facility. By considering the coverage terms, limitations, and premium costs of long-term care insurance policies, individuals can make informed decisions to secure the financial support they need for assisted living expenses.

Limitations of Long Term Care Insurance for Assisted Living Costs

Long-term care insurance can be a valuable resource for covering the costs of assisted living, but it’s important to be aware of its limitations. One major limitation is the fact that not all long-term care insurance policies cover assisted living expenses. It’s crucial to thoroughly review the terms of any policy you’re considering to ensure that it includes coverage for care provided in an assisted living setting.

Policy Limitations

Some long-term care insurance policies may have limitations on the types of assisted living expenses that are covered. For example, certain policies may only cover specific services such as personal care tasks or therapy, while excluding other services like laundry and housekeeping. It’s important to carefully review the coverage details to understand what is and isn’t included in the policy.

Eligibility and Pre-existing Conditions

Another limitation to consider is eligibility requirements and pre-existing conditions. If you or your loved one already has a pre-existing medical condition, an insurer may consider you high risk and deny your application for coverage. Additionally, some policies may not cover expenses related to pre-existing conditions, so it’s important to clarify these details before purchasing a policy.

Cost and Coverage Limits

Long-term care insurance policies also typically have cost and coverage limits. This means that the policy may only pay benefits up to a specified daily limit or for a certain period of time. Additionally, there may be a maximum lifetime benefit, which is the total amount the policy will pay out for your care. It’s important to understand these limits and consider whether they align with your potential long-term care needs.

In conclusion, while long-term care insurance can provide valuable coverage for assisted living costs, it’s essential to carefully review the policy’s limitations and terms to ensure that it meets your specific needs. It’s advisable to seek guidance from a licensed insurance agent or financial advisor to navigate these limitations and make an informed decision.

How to Select Long Term Care Insurance for Assisted Living Coverage

When selecting long-term care insurance for assisted living coverage, it’s important to consider several factors. First, review each policy thoroughly, including its coverages, terms, and exclusions. All long-term care policies are different, so it’s essential to understand what each one offers.

Next, shop around with different carriers and get quotes on various types of policies. Comparing costs, benefits, and drawbacks will help you make an informed decision about which policy is the best fit for your needs.

It’s also crucial to avoid buying more coverage than you need. If you have sufficient income/savings or support from family members, you may not have a large financial burden from long-term care. On the other hand, be cautious not to buy too little coverage, as this could leave you with insufficient funds to cover your long-term care costs.

Additionally, make sure you can comfortably afford the monthly premium payment. Long-term care insurance rates will likely go up over time, so it’s important to choose a policy that fits within your budget.

Finally, consider seeking the advice of a professional, such as a licensed insurance agent or financial advisor, to help guide you through the process of selecting the best long-term care insurance for assisted living coverage. Their expertise can provide valuable insights and ensure that you make the right decision for your long-term care needs.

Conclusion: Making Informed Decisions about Assisted Living and Long Term Care Insurance

When it comes to making decisions about long-term care insurance and assisted living, it’s important to be well-informed. Understanding the coverage terms, limitations, and premium costs of long-term care insurance is crucial in order to make the right choice for your future needs. It’s also important to consider the various care options that long-term care insurance may cover, such as nursing home care, home health care, adult day health care, hospice care, and memory care.

Key Considerations for Informed Decision Making

– Review each long-term care policy thoroughly, including its coverages, terms, and exclusions.

– Shop around with different carriers and get quotes on various types of policies to compare costs, benefits, and drawbacks.

– Consider your individual needs and financial situation to determine the right amount of coverage for you.

– Seek the advice of a professional, such as a licensed insurance agent or financial advisor, to ensure you are making the best decision for your long-term care needs.

By taking the time to educate yourself and carefully consider your options, you can make informed decisions about long-term care insurance and assisted living that will provide you with the financial security and support you need in the future.

In conclusion, long-term care insurance can provide coverage for assisted living facilities, but the specific coverage and eligibility requirements can vary between policies. It’s important to carefully review the terms of your policy to understand what is and isn’t covered.